SEP IRAs are inclusive, allowing both business owners and employees to participate. This makes them suitable for businesses of all sizes, including sole proprietorships, partnerships, and corporations.

Employee Benefits: Employees benefit from employer-funded contributions, helping them build a retirement nest egg. Unlike other retirement plans, employees are not required to contribute from their earnings.

No Ongoing Administrative Burden: SEP IRAs do not involve complex administrative requirements, reducing the administrative burden on your business.

Attracting and Retaining Talent: Offering a retirement plan like a SEP IRA can enhance your employee benefits package, making your business more attractive to potential hires and aiding in employee retention.

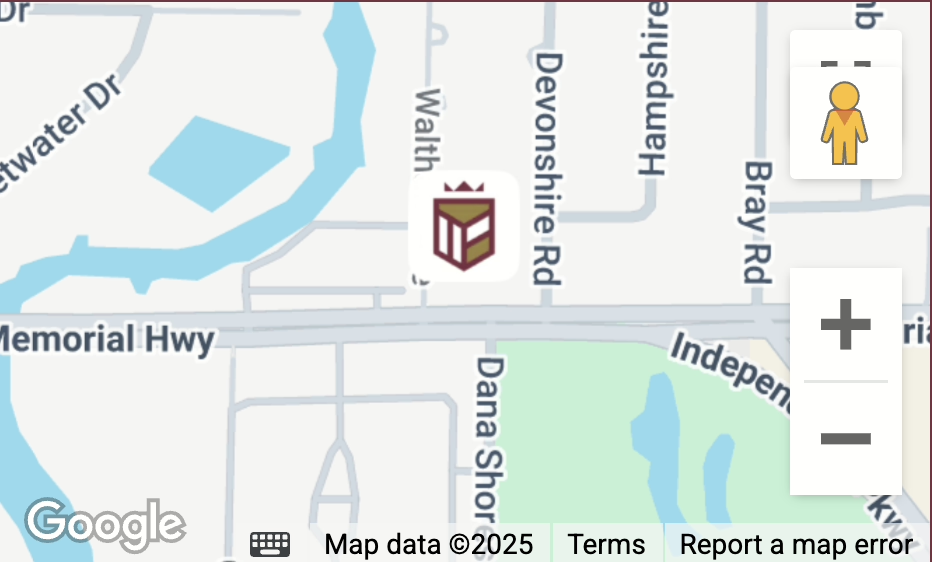

At Taylor Financial, we specialize in assisting businesses in implementing SEP IRAs as part of their investment strategy. Our financial professionals will work closely with you to tailor a plan that aligns with your business goals and supports your employees’ financial futures.