Adam Taylor, CA

Insurance License #0K44193, domiciled in FL

Mike Everritt, CA

Insurance License #4200532, domiciled in FL

Thomas Yannetti

Insurance License #4218984, domiciled in FL

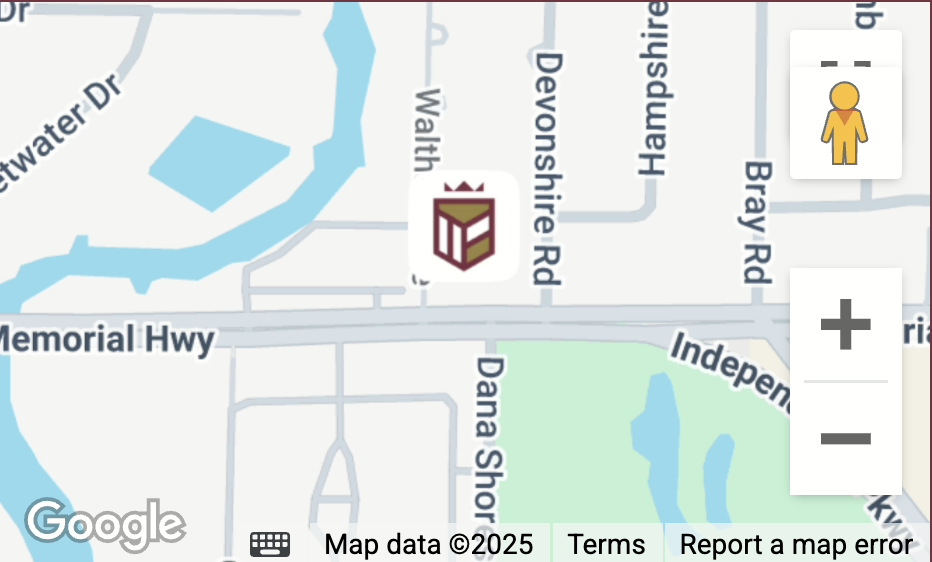

TAMPA

5321 Memorial Hwy, Tampa, Florida 33634

Check the background of your Financial Services Professional on FINRA’s BrokerCheck.

Securities and investment advisory services offered through qualified representatives of MML Investors Services, LLC, Member SIPC. Taylor Financial is not a subsidiary or affiliate of MML Investors Services, LLC, or its affiliated companies. Supervisory Office 4830 W. Kennedy Blvd., Suite 800 Tampa, FL 33609, (813) 286-2280 The firm is licensed to sell insurance in the following jurisdiction(s): FL, CO, HI, GA, MD, NC, NH, NY, OH, PA, TN, TX, VA, WA. Licensed to sell securities in the following jurisdiction(s): FL, GA, LA, MD, MA, NY, NC, TN, TX.

CRN202609-5045237